The Fiscal Year (FY) 2021 IPPS Final Rule clarifications do not change certain criteria for providers seeking Medicare bad debt reimbursement. Implicit price concession informs external financial reporting of bad debt, but it has no impact on the underlying transaction of writing off patient deductible and coinsurance as uncollectible. This terminology is related to all patient account activity and not specifically Medicare bad debts for uncollectible deductibles and coinsurance for covered services. The 2021 IPPS Final Rule, published September 2020, further clarified how providers should treat Medicare bad debt in their accounting records, while also adopting the Financial Accounting Standards Board terminology for “implicit price concession.” Similar to the previous terminology of “allowance for uncollectible accounts,” implicit price concession represents providers’ estimates of the collectability of remaining balances, based on actual write-off experience and other factors. The CMS article explains that crossover bad debt amounts should be charged to an expense account for uncollectible accounts and explicitly states, “Do not write off to a contractual allowance account.” These requirements were effective for cost reporting periods beginning on or after October 1, 2019. Prior to these instructions, providers would often treat the remaining unpaid deductibles and coinsurance as deductions from revenue (Medicaid contractual allowances), because Medicaid was the last payer involved in the history of the account. If the Medicaid agency determines it does not have any liability for the unpaid deductibles and coinsurance, the provider is notified, and the amount can be claimed as a Medicare bad debt without exhausting the normal collection effort requirements of non-indigent (traditional) bad debts.

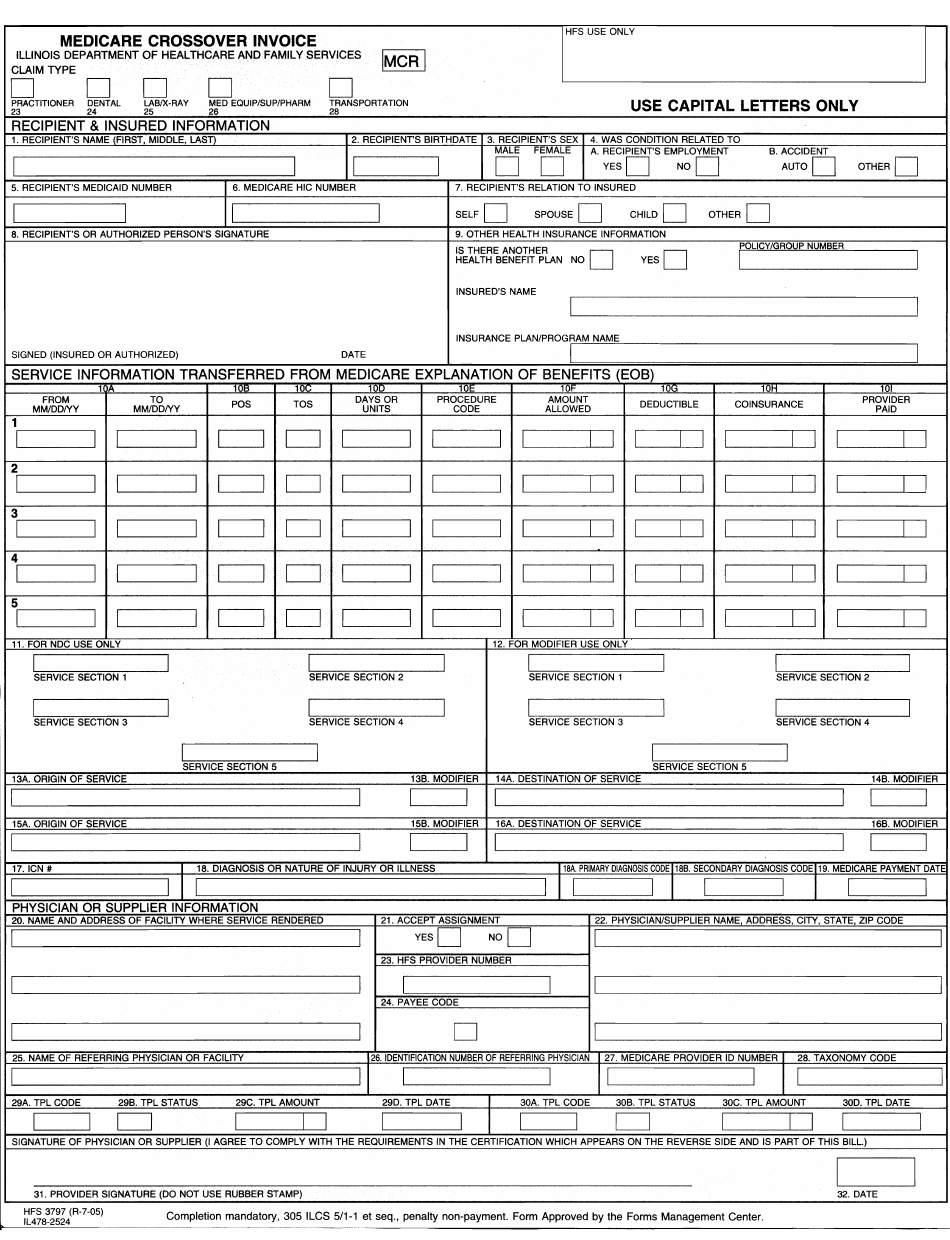

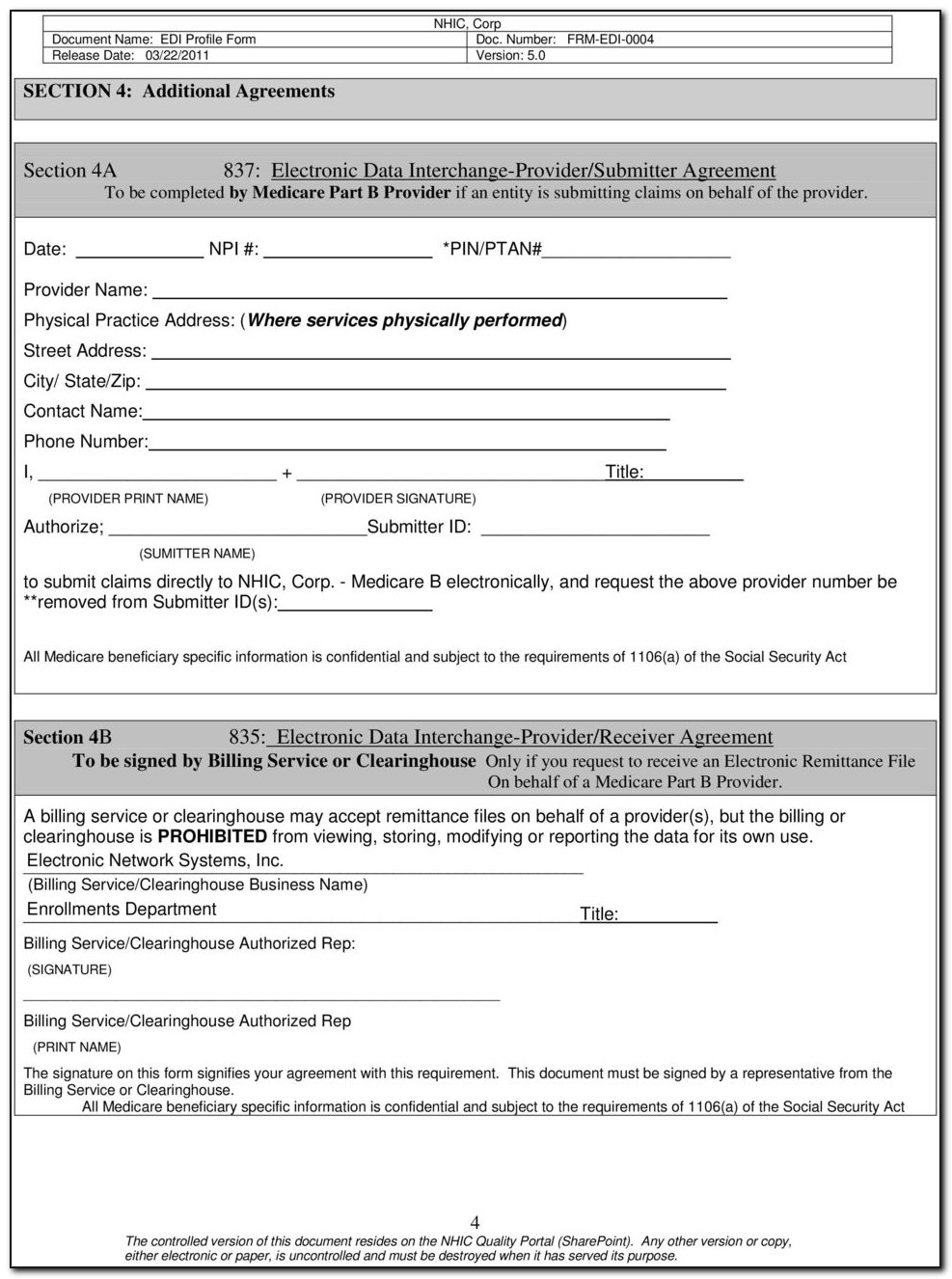

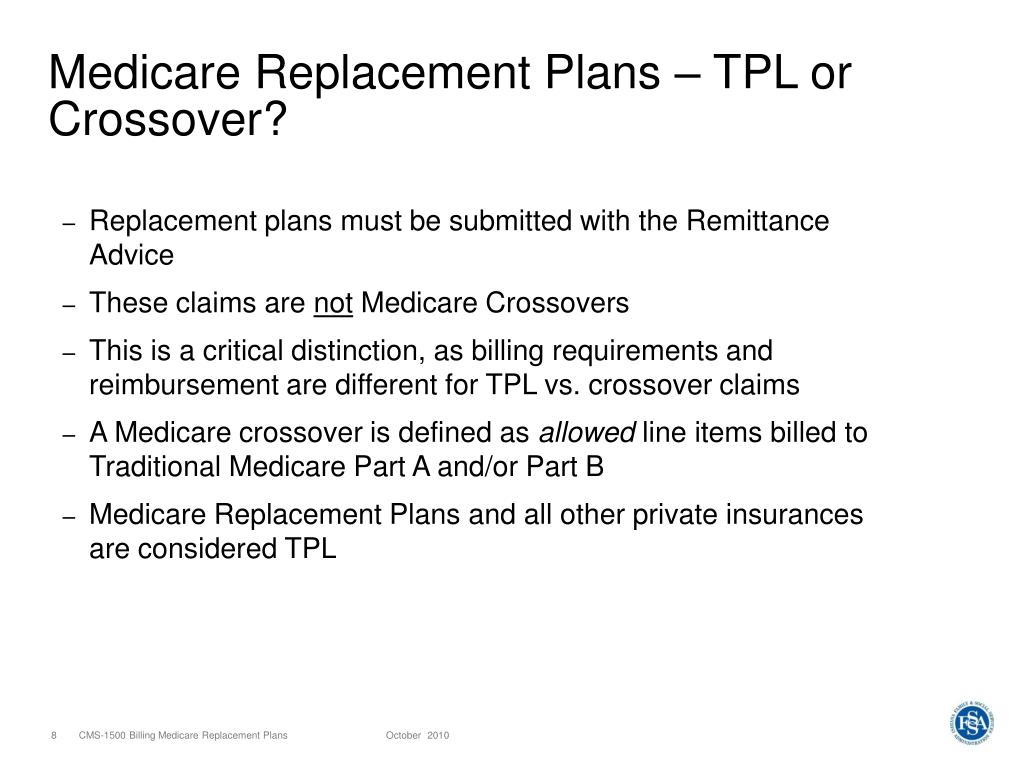

After Medicare makes its payment, any deductible and coinsurance amounts are “crossed over” to the responsible Medicaid agency. The term “crossover claims” refers to Medicare beneficiaries also entitled to Medicaid. On April 4, 2019, CMS provided clarification through a Medicare Learning Network article titled “Medicare-Medicaid Crossover Bad Debt Accounting Classification,” instructing providers to “correctly classify unpaid deductible and coinsurance amounts for Medicare-Medicaid crossover claims” in their accounting records. Providers also must continue to comply with applicable regulations and PRM guidance (Chapter 3), which includes indistinct information for properly classifying unpaid deductible and coinsurance amounts in accounting records. Also, CMS has proposed a new format for Medicare bad debt log submission for cost reporting periods beginning on or after October 1, 2020.

Medicare crossover definition manual#

The Final Rule clarifies and codifies Provider Reimbursement Manual (PRM) guidelines related to accounting treatment, along with several other requirements.

Specifically, providers seeking Medicare bad debt reimbursement from the Centers for Medicare & Medicaid Services (CMS) are adapting to significant changes related to IPPS Final Rule codifications and Paperwork Reduction Act (PRA) formatting guidelines. Proactive education and a collaborative effort between revenue cycle and reimbursement functions are key in addressing these new challenges. The various accounting treatment clarifications for Medicare bad debt reimbursement, combined with the recent 2021 Inpatient Prospective Payment System (IPPS) Final Rule changes, are presenting significant challenges for many providers, particularly those with limited resources.

0 kommentar(er)

0 kommentar(er)